DELAWARE- DelDOT is requesting an 8.3 percent budget increase from the state.

Officials attribute the loss of pandemic stimulus funding as one of the primary drivers for the increase. However, concerns among lawmakers are emerging regarding the potential impact of electric vehicle (EV) regulations on DelDOT's future budget.

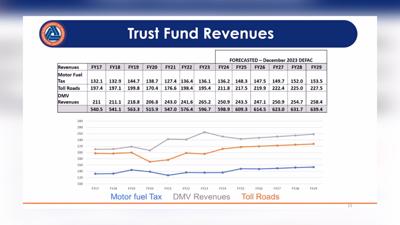

Presently, the motor fuel tax constitutes about 14 percent of DelDOT's budget, but the growing prevalence of electric vehicles in the state raises questions about the sustainability of this revenue source.

Under the Delaware Department of Natural Resources and Environmental Control's (DNREC) clean car regulations, 82 percent of new cars sold in the state should be electric by 2032.

Despite only about 3.5 percent of vehicles currently being electric, the motor fuel tax is still generating sufficient revenue. However, lawmakers are expressing preemptive concerns.

Senator Eric Buckson (R-Dover) emphasized the need for a plan to address the potential impact, stating, "If we don't come up with a plan on how to fix it yet, that's fine, but we better have a model for what a 15 percent fleet looks like or 25 percent fleet looks like in the year 2027."

According to taxfoundation.org, 24 states impose a higher annual vehicle registration fee for electric vehicles and some hybrid vehicles to offset forgone gas tax revenue. These fees range from $50 in Hawaii and South Dakota to $200 in Ohio, West Virginia, and Wyoming.

Concerns over the affordability of electric cars persist, with David Garavito of Dover noting the already daunting cost for many individuals. David commented, "If they are going to lose at the gas station, they will have to make it up. Is it a good idea to make it on registration? I don't know; it's already high."

DelDOT officials report that the University of Delaware is actively working on a report to analyze the future impact of electric vehicles on motor fuel tax revenue. The results of this report are anticipated to be available this spring.